Laptop HP ENVY 17-cr0036nn cu procesor Intel® Core™ i7-1260P pana la 4.70 GHz, 17.3 FHD IPS, 16GB DDR4, 512GB PCIe SSD,Intel Iris Xe, Windows 11 Home, Natural Silver - eMAG.ro

Rent HP OMEN Gaming Laptop 16-b0005dx - Gaming Laptop - Intel® Core™ i7-11800H - 16GB - 1TB SSD - NVIDIA® GeForce® RTX 3070 from $84.90 per month

Laptop HP, ENVY 17-CH0001NA, Intel Core i7-1165G7, 16GB, SSD 1TB, Intel Iris Xe Graphics, Windows 10, Argintiu - eMAG.ro

Laptop HP ELITEBOOK 820 G3, Intel Core i7-6600U, 2.60 GHz, HDD: 256 GB, RAM: 8 GB, video: Intel HD Graphics 520, webcam

Laptop HP ENVY 17-cr0036nn cu procesor Intel® Core™ i7-1260P pana la 4.70 GHz, 17.3 FHD IPS, 16GB DDR4, 512GB PCIe SSD,Intel Iris Xe, Windows 11 Home, Natural Silver - eMAG.ro

Laptop HP EliteBook Folio 1040 G3 14" i7-6600U SSD 256GB, cu Windows 10 Home MAR - refurbished PC House

Laptop HP Spectre x360 cu procesor Intel Core i7-12700H, 16" 3K+ (3072 x 1920), Touch, 16GB DDR4, 512GB SSD, Intel Iris Xe Graphics, Windows 11 Home, Nightfall black - eMAG.ro

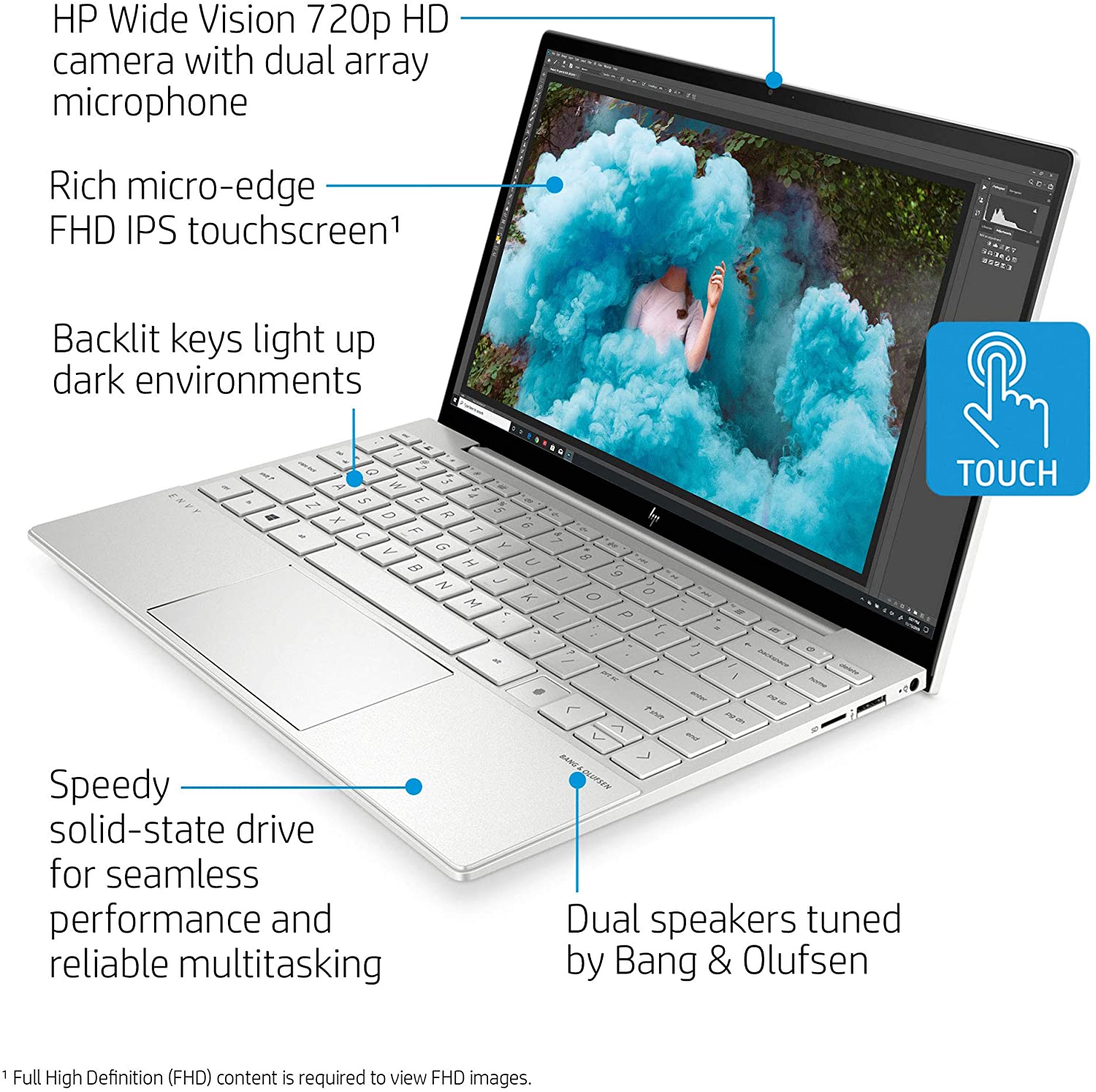

Amazon.com: HP Newest Envy 17.3" Full HD Touch Business Laptop, 11th Gen Intel i7-1165G7 Quad CPU, 1TB SSD NVME, 16GB DDR4 3200 RAM, Long Battery Life, Webcam, Barley 8 Accessories, Windows 10

HP Omen Gaming Full HD IPS 17.3" Notebook, Intel Core i7-7700HQ QC Processor, 16GB Memory, 1TB Hard Drive + 128GB SSD, 2GB NVIDIA GTX 1050 Graphics, Bang & Olufsen Audio, Backlit Keyboard,

Laptop HP ZBook Fury 15 G8, i7-11800H, 15.6 inch, RAM 32GB, SSD 1TB, NVIDIA T1200 4GB, Windows 10 Pro, Dark Ash - DABSTORE.ro

Omen By HP Laptop, Intel Core i7 Processor, 32GB Ram, 1TB HDD + 256GB SSD, 6GB Nvidia Graphics 15.6 Inches - Foretec Marketplace

Amazon.com: Newest HP Envy 17t Touch(10th Gen Intel i7-1065G7, 32GB DDR4 RAM, 1TB PCI NVMe SSD, NVIDIA GeForce 4GB GDDR5, Windows 10 Professional, 3 Years McAfee Security Key) Bang & Olufsen 17.3"

HP Envy X360 13 2-in-1 Business Laptop 13.3" FHD OLED Touchscreen 11th Gen Intel Quad-Core i7-1195G7 8GB DDR4 1TB SSD Intel Iris Xe Graphics Backlit KB Fingerprint B&O Thunderbolt WiFi6 Win11 Silver -

HP Envy 13 Laptop, Intel Core i7-1165G7, 8 GB DDR4 RAM, 256 GB SSD Storage, 13.3-inch FHD Touchscreen Display, Windows 10 Home with Fingerprint Reader, Camera Kill Switch (13-ba1010nr, 2020 Model) – Intech Computer shop

HP Pavilion 15 – 11th Generation intel Core i7, 16GB Ram, 1TB SSD, NVIDIA GeForce Graphics, B&O Speakers, Touchscreen, Backlit Keyboard, Windows 10. | McSteve

HP EliteBook 840 G3 Business Laptop, Intel Core i7-6th Gen. CPU, 16GB RAM, 512GB SSD Hard, 14.1 inch Display, Windows 10 Pro

Amazon.com: HP Envy Laptop, 17.3" IPS Touchscreen, Intel Core i7-1165G7, GeForce MX 450, 32GB RAM, 1TB PCIe, Backlit Keyboard, Fingerprint Reader, Wi-Fi 6, Audio by Bang & Olufsen, Win 11 : Electronics